Ubiquitous [yoo-bik-wi-tuhs]

adjective: existing or being everywhere, especially at the same time; omnipresent

If anything can be said to be ubiquitous in the AV industry, it’s the humble light-emitting diode (LED). From indicator lamps, to towering videowalls, to 4K televisions, to smartphones, the LED has become an essential part of our daily lives—a part we largely take for granted. We use them to illuminate our homes, as headlamps and brake lights on cars, as backlights for our laptop screens, and to keep garage doors from closing on children and pets.

Until recently, LEDs worked mostly in the background. That’s all changing, though—and changing rapidly—as LEDs become the preferred way to communicate information and show video on large screens. Along the way, they’re coming to surpass walls of liquid crystal display (LCD) panels and stepping over high-brightness laser-phosphor projectors.

Today, you could make a convincing argument that the LED is the most disruptive technology to hit the AV world ever. But it’s been a long time coming.

A Long Time Ago

Five years before the sinking of the RMS Titanic, an obscure engineer named Henry Round, who worked for Marconi’s Wireless Telegraph Co. (which supplied the spark gap radio transmitters and receivers for the ship), applied a small voltage to a crystal of silicon carbide (aka carborundum) and observed it to emit a weak colored light. Round was trying to find a better “cat’s whisker” diode detector for receiving long-wave radio signals used for telegraphy, and, although his discovery was intriguing, it was hardly useful to his research.

Round went on to author an article about his findings in a 1907 issue of Electrical World, a special-interest magazine of the day. Round stated that, when he applied a DC voltage in the range of 10V to 11V, he could observe yellow, green-orange and even blue light from the point of contact. He concluded his article by stating, “The writer would be glad of references to any published account of an investigation of this or any allied phenomena.”

Round couldn’t know it at the time, but, in fact, he had created the world’s first LED. By passing an electrical current through a makeshift semiconductor junction, photons were being emitted, and, apparently, some of the crystals he tested emitted enough light to rival a candle. Alas, Round dismissed the effect as a mere curiosity, and he moved on to other things.

The next mention of LEDs occurred in the late 1920s, when a Russian engineer, Oleg Losev, continued Round’s experiments with crystal detectors and published several technical papers that described the behavior of different crystals and voltages. Losev described the spectral emission of each crystal in detail, and he even experimented with cooling the crystals to very low temperatures to confirm the effect was based on current flow, rather than heat. Losev was killed during the Nazi siege of Leningrad in World War II, but he had accumulated four patents based on the research he’d done before he died.

After the war, a number of scientists continued their explorations of these rudimentary semiconductors, now available as point contact diodes. Additional LED patents were filed in the 1950s by Kurt Lehovec, Carl Accardo and Edward Jamgochian. In 1957, Rubin Braunstein of RCA Labs tested compounds of gallium arsenide, gallium antimonide, indium phosphide (in use today in quantum dots) and silicon germanium as light emitters. Braunstein even developed an infrared (IR)-based pulse-modulation system to transmit music from a record player across a room, detecting the IR light pulses with a photodiode and playing back the decoded music through an amplifier.

The Next Steps

Until 1961, LEDs were still regarded as laboratory novelties. However, in September of that year, two engineers at Texas Instruments (TI)—James Biard and Gary Pittman—developed a practical near-IR diode emitter, again using a junction of gallium arsenide. This device was quickly patented by TI, and it went into mass production as the SNX-100 light-emitting diode.

The second development that helped pushed LEDs into the mainstream came a year later, at General Electric, where Nick Holonyak, Jr., created the first visible-spectrum LED. It emitted a bright red color, and it had potential as a simple power indicator or as part of a numeric indicator. A decade later, one of Holonyak’s graduate students, M. George Craford, invented the first yellow LED and found a way to improve the brightness of Holonyak’s first LED by a factor of 10.

Until about 1970, LEDs were quite expensive. Then, Monsanto found a way to mass-produce red LEDs as indicator lamps at reasonable prices. A few years later, the development of a planar-LED-chip manufacturing process at Fairchild Semiconductor finally realized the cost reductions and packaging breakthroughs for which everyone had been searching. (It only took seven decades following Henry Round’s initial discovery.)

Yet, there were two more obstacles to overcome before LEDs could realize their full potential….

Here, There And (Almost) Everywhere

For most of the 1970s and 1980s, LEDs were primarily used as indicator lamps and as part of alphanumeric displays. There was a lot of interest in using LEDs for digital signage, but the big hold up was the lack of dark-blue and bright-green LEDs. The forerunners of today’s LED walls—the original JumboTron and Diamond Vision screens—burned through expensive and short-lived red, green and blue cathode-ray tubes and then fluorescent lamps to create coarse color images with half the resolution of a VHS tape. There had to be a better way!

It wasn’t until 1994 that a scientist at the Nichia Corp. by the name of Shuji Nakamura finally figured out how to make a high-brightness blue LED. The “recipe” involved mixing gallium nitride and indium nitride, growing the crystals on sapphire and using a scanning beam microscope to remove hydrogen impurities to maximize brightness. The right color of green soon followed, using a similar compound. The significance of Nakamura’s discovery earned him a Nobel Prize two decades later.

If you were active in the display industry a quarter-century ago, you’ll remember those days as a constant challenge to build a high-brightness electronic display with both a sufficiently small pitch and decent color reproduction to work as electronic scoreboards—albeit very expensive ones. In the late 1990s, your choices for outdoor LED arrays ranged from 10mm to 20mm, with the finest available pitch being 4mm.

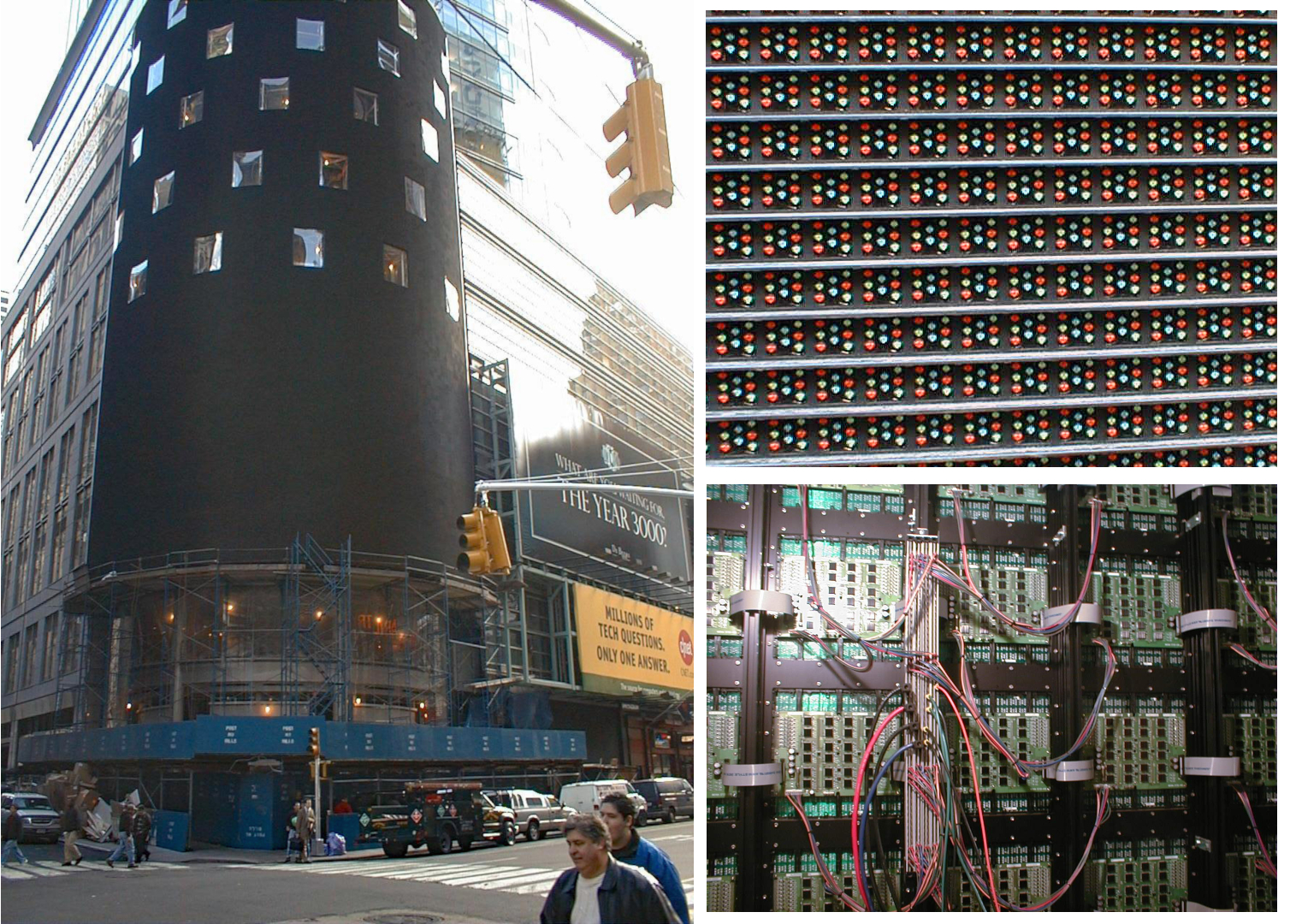

Those displays certainly cranked out the photons, with the typical stadium screen capable of 3,000cd/m2 to 5,000cd/m2. That was no mean achievement, given that bright sunlight on a clear day could measure three times that level on bright objects! In 1999, I had the opportunity to tour the newly built NASDAQ MarketWall in Times Square, in New York NY. That installation featured large tiles with a pitch of about 10mm to 12mm, and it could deliver 5,000cd/m2 at full brightness!

Back then, the big challenge for LED walls was power consumption. The few staging companies that were working with LEDs for live events had to scale up their power requirements to handle these bright displays. Even a 400cd/m2 LED wall required a 15A, 120 VAC connection back then, consuming close to 1800W per LED panel. And those early LED panels (to be known later as “tiles”) often used twice as many green LEDs as red and blue ones to achieve their target brightness.

Not surprisingly, heat dissipation was a big problem with LED walls. In one notable (or perhaps notorious) example, a prominent LED wall installed across the street from the NASDAQ MarketWall just before the turn of the millennium caught on fire during operation and became reduced to a large block of melted plastic and metal. (The advertiser solved the problem by hastily covering the wall with a plastic tarp printed with its logo.)

Getting To Know You

A few years after touring the NASDAQ wall, I had the occasion to visit a prominent manufacturer of displays in Europe; there, I was shown a prototype 3mm LED wall. It was running at full brightness, developing somewhere in the range of 3,000cd/m2, and I actually had to put on sunglasses. It was that bright. The manufacturer’s goal was to come up with a finer-pitch LED tile that could break through the indoor-display marketplace—one with a dot pitch that could be viewed at close range and not break into an unrecognizable cluster of big, colored dots.

At the time, it was considered too expensive to push LED pixel pitches much below 4mm. For really big indoor screens, high-brightness LCD and DLP projectors, along with large tiles of plasma displays and rear-projection videowalls, were doing the heavy lifting. LEDs just weren’t on enough people’s radar—especially after LCD panels started to hit the market in the mid-2000s, and, in so doing, pushed plasma toward the exit door.

Some rental-and-staging companies had been rigging and flying LED walls for a few years, but, for close-up viewing, projection was still “the comfort zone.” Part of the problem was reliability. You could spend hours building a large LED wall and hoist it into place, only then to have a tile or two suddenly go dark because of a power-supply failure. And then there was the problem of color uniformity over the wall. LEDs are manufactured in batches, and tile manufacturers are pretty careful to match colors for a given production order of tiles. (This practice continues to this day.) By contrast, the appeal of a single projected image was obvious: Brightness and color uniformity were excellent, and projectors were simply stacked to make sure the show would go on in the event of a lamp failure.

The New Kid On The Block

No one is really sure when LEDs really matured and started their assault on once-safe strongholds for LCD walls and projectors, but it can be said that, earlier this decade, the tide turned. I recall walking the show floor at ISE in 2013 and being amazed by the sheer number of LED-wall manufacturers (most of them from China). In short order, a succession of finer-pitch LED tiles popped up at major trade shows.

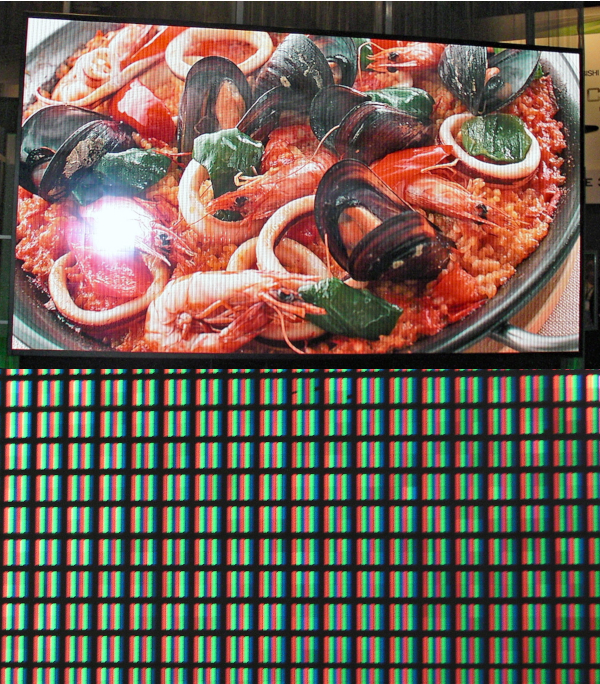

First, it was 2.5mm; then, 2mm; then, 1.8mm; that was followed pretty quickly by 1.6mm; then, 1.2mm. At that point, LED-tile manufacturers had achieved the same pitch as a 1998-vintage 50-inch plasma monitor with WXGA resolution. In recent years, we’ve also seen 0.9mm, 0.85mm and 0.8mm LED walls for sale (many incorrectly labeled as microLEDs), along with 0.7mm LED wall prototypes.

Suffice it to say that, at those resolutions, you could stand right next to an LED wall and not detect any pixels—that is, as long as the wall’s sheer brightness wasn’t too much for you! It didn’t take long for industry analysts to predict that we’d soon have LED displays inside meeting rooms and classrooms to replace large LCD displays (which had already banished “hang-and-bang” projectors to the scrap heap).

With a combination of fine pixel pitches in large screen sizes, LED walls could now show 4K content, and, with their high brightness and super-saturated colors, high-dynamic-range (HDR) video was a piece of cake. What’s more, the pulse-width modulation (PWM) technique used to switch LED walls on and off rapidly to achieve a full range of gray and color shades means that LED walls are ready for high-frame-rate (HFR) video, too.

No Turning Back Now

Anyone who walked the InfoComm show floor this past June can clearly see the writing on the wall. (It was certainly bright enough in Orlando FL’s Orange County Convention Center!) Just about every manufacturer of displays now has a play in LED walls, either as its primary offering or as a plan B to supplement its lines of high-brightness DLP projectors and LCDs. Somewhat surprisingly, even some smaller projector brands have gotten on board with LEDs.

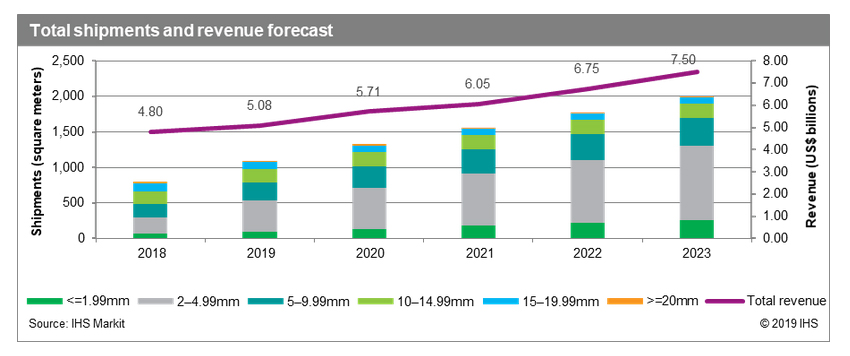

If you follow the numbers, the reasoning is obvious. According to research firm IHS Markit, “[W]orldwide LED video display area shipments are expected to expand by 36.7 percent in 2019 as several factors, including plunging prices, make them a more attractive alternative to projectors and flatpanel displays.”

The firm’s latest report, from this past July, predicts that total worldwide shipments (in LED area) will reach 1.1 million square meters—up from 800,000 square meters last year—for a total of $5.1 billion in revenue. By 2023, IHS Markit predicts area shipments will have reached two million square meters, generating $7.5 billion in revenue.

“LED video-display technology is rapidly replacing front projectors in large venues,” Tarika Bheda, Research and Analysis Director, Digital Signage, at IHS Markit, said. “The technology is also aggressively competing with LCD videowalls in indoor applications, such as command-and-control rooms and premium conference rooms. [Apart from the] declining cost, lifespan, size scalability and seamless image display are the main factors driving the increasing adoption of LED video technology.”

The indoor-digital-signage segment is where the real disruption is taking place. Bheda said that almost half of the LED displays shipped this year are targeted at indoor installations; the 2mm to 4.99mm pixel-pitch category is dominating the market. This category is forecast to capture 52-percent share of the global LED display market by 2023, and the “up to 1.99mm” category will expand from nine percent to 13 percent during that time period.

Other analysts are predicting strong growth for fine-pitch LED, as well. Futuresource Consulting’s Global Videowall Display Solutions Report, published this past July, pegs the compound annual growth rate (CAGR) for the global narrow-pixel-pitch (NPP, ≤2.5mm) LED market growing at 32 percent for 2015 to 2022, with $3 billion in total revenue expected by the end of this year. Even with the possibility of tariffs looming on Chinese goods, “LED technology will remain resilient over the long term, continuing to outpace growth in LCD and projection, and [it is] on track to achieve global revenues of $11.7 billion by 2023,” Futuresource Consulting forecasts indicate.

Just as we’ve seen with LCD displays, aggressive competition and excess fab capacity is pushing down prices for finished LED panels. According to IHS Markit, “[C]ompetition among brands has intensified, pulling average selling prices (ASPs) lower. However, revenue growth is projected to remain positive as ASP erosion will be balanced by an increase in demand for expensive, fine-pixel-pitch displays.” The firm expects the public-space application to be the largest through 2023, with transportation, control-room and corporate installations growing at a fast pace during that period.

Indeed, several companies are now showing “build-it-yourself” LED screens in the 130-inch to 150-inch range. These displays can be assembled by two people in about three hours, and they can be mounted to a wall or attached to a roll-around stand. Just plug in the power cord, connect your video sources (most likely a presentation switcher) to the HDMI port and away you go with up to 800cd/m2 of bright, colorful, high-resolution imaging.

The impact on projector sales and related accessories, such as mounts, is substantial. Although it’s expected that projectors will retain their position in the budget-conscious K-12 education segment (in particular, short-throw models), as well as in cinemas, LED displays, combined with ever-cheaper and ever-larger LCD panels with 4K resolution, will cause some pain. Indeed, according to AVIXA’s Industry Outlook and Trends Analysis (IOTA) 2019 report, the installed video-projection and accessories market will face a CAGR of -19.7 percent, going from $5.8 billion this year to $1.9 billion in 2024.

Where To From Here?

Trying to predict technology trends in the AV marketplace is sometime a fool’s errand. LED displays are different, though. Their powerful combination of large screen sizes, fine pixel pitches, high brightness and saturated colors has the potential to push aside just about every other display platform. And the vigorous pricing competition we’re seeing among all the LED-tile manufacturers in China is making this transition happen at hyper speed.

Just think of all the arenas, stadiums, shopping malls, plazas, airports and train stations you’ve walked through—even the highways on which you’ve driven. Chances are, you’ve passed one or more LED displays and gave them a quick glance. And, if you did, you surely noticed how bright and colorful they were. (On a personal note, every rock and pop concert I’ve attended during the past six years has used LED walls for image magnification—not a single large or medium-sized venue relied on front or rear projection.)

LED-driven applications don’t stop there, either. If you happen to live in or near Chatsworth CA or Richmond TX (Houston area), you can now watch first-run films on large LED screens, calibrated for cinema playback. The week following InfoComm, I traveled to Texas to catch a screening of “Men In Black: International” on a 46-foot-wide LED screen that had a 3mm pitch, 4224×2160 resolution and a peak brightness level of about 16fL to 20fL with “enhanced” dynamic range content. With HDR test content, the peak brightness level soared to 50fL, which is equivalent to nearly 180cd/m2.

But wait…there’s more! Although individual LEDs measuring roughly 100μm to 2mm in size qualify as “mini” LEDs (currently used as backlights in full-array LCD TVs), a new generation of microLEDs is in the works. These super-tiny devices (50µm to 100µm) are small enough to replace the LCD and OLED screens in mobile phones, tablets, laptops and televisions. (The LEDs discussed in this article use an inorganic semiconductor junction, as opposed to the organic light-emitting diodes (OLEDs) found in 4K TVs and smartphones.)

Some pretty big names in consumer electronics (two of which dominate the smartphone business) are currently building research-and-development facilities and pilot fabrication lines in the US and Asia to figure out how to make microLEDs in sufficient quantities with acceptable yields. They are exceedingly difficult and expensive to manufacture at present—but then, so, too, were color plasma displays in the 1990s and large LCD TVs in the 2000s. And we all know how those stories turned out….

If Henry Round were alive today, he would be astounded at how his once-insignificant discovery has become an indispensable part of everyday life. Indeed, modern cruise ships employ hundreds of thousands of LEDs to illuminate decks and rooms, light up digital signs, provide image magnification for onboard entertainment, and, of course, serve as status lamps and numeric indicators on the bridge and throughout the ship.

LEDs are, indeed, the mouse that roared….

Sidebar: The Industry’s Take On LED Displays

What’s with the race to fine pitch? Are LEDs the favorite of the rental-and-staging business? How about LED power consumption? Is LED cinema the next big thing? I queried several LED (and projector) brands, kept anonymous here, to get their perspective on these questions.

Sound & Communications: Just how fine a pitch do we really need for LED tiles?

A: We saw adoption of 1.2mm- and 0.9mm-pixel-pitch LED videowalls increase significantly over the past year, primarily because the offerings better met customer requirements and expectations. We are currently shipping LED product down to 0.7mm. As you approach a 0.6mm pitch, I think you begin to reach diminishing returns on pixel density.

A: A 2mm to 2.5mm [pixel pitch] is the mainstream for the industry, and these displays are going into casinos, lobbies, museums, retail spaces, hotels, transportation hubs and more with the general viewing distance of 20 feet or more.

A: There has been a rat race for the tightest pitch [in] the past years, but we notice that the race has stopped around the “sweet spot” of 1.2mm. We offer a 0.9mm [option]—and some manufacturers offer [down] to 0.7mm even—but the adoption curves for these is slow, since the price of the product grows exponentially with the lower pixel pitch. With the current “packaged” LEDs, it is practically impossible to lower the pixel pitch further. With new technologies on the horizon, this could, of course, all change.

Sound & Communications: What impact have LED videowalls had on the rental-and-staging industry—specifically, at the expense of high-brightness projection? It seems like, these days, every touring musical act uses LEDs exclusively.

A: While projection is still less expensive, it does not have the impact that LED has, which is why [it is] becoming the preferred solution where impact is desired.

A: A lot of LED is used in the event space, indeed. The pixel pitch, however, is still 4mm on average, with exceptions that use 2.5mm due to the fragility of the product. Projection still has a major role to play, but it requires more in-depth knowledge than LED to perfect.

A: [For] concerts, events and touring, LED has taken over as the preferred display technology. The reasons are pretty fundamental: brightness, color, structural flexibility and optimized touring designs that offer fast, no-tools setup, tear down and repair.

A: A lot of work has gone [into developing] tiled LEDs for rental that are easier to handle, lighter and simple to assemble for events. Special carriers and logistic systems also help avoid damage. The industry has developed “wholesale” rental LED suppliers for events and “tile pools” to deal with peaks of demand.

Sound & Communications: How about brightness and power consumption? As many customers have discovered, you don’t need a couple thousand nits to overcome normal ambient room lighting. In fact, you can get by with a lot less, which reduces power consumption.

A: The LED maximum-brightness requirement is a direct correlation to the room environment. For example, a typical meeting room with low to no ambient light can be serviced with 600cd/m2 brightness or less. However, high-ambient-light environments, such as atriums, lobbies and boardrooms with floor-to-ceiling windows, require higher [brightness of] 1000cd/m2.

A: LED power consumption varies significantly based on the content. Rather than the constant backlight power draw associated with LCD, the direct-view pixels vary in color and brightness, [as well as] power consumption, in real time, based on content. The LEDs are very efficient, and [they’re] becoming more efficient every day. This translates to more brightness [nits] for the same power, or vice versa. In our experience, it is very common for customers to be operating the LED displays at 50 percent of the maximum brightness.

A: One of the challenges today for LED walls is cabinet consistency, because, if you lose one, it can affect the entire screen. We leverage dual redundant power supplies to address this need. There is no real cookie-cutter standard for indoor use, due to several variables that need to be taken into account, including optimal viewing distance and ambient light. Even though the human eye is capable of seeing a huge range of brightness, there’s a comfort limit, and it varies per person.

Sound & Communications: What about LED cinema? It’s a very new concept, but it’s gathering plenty of interest.

A: Cinema products based on LED technology hold the promise of requiring less space in theaters, providing higher dynamic range for the film’s image and, with higher maximum brightness, allowing for different lights-on usage of theater spaces. Of course, there are certainly technical challenges associated with trying to match and exceed the visual performance of [a] traditional theater, but the race is on. We will surely start to see more and more LED in cinema.

A: LED in cinema still has a long way to go. It is not affordable enough; proof of that is the limited installed base. [Moreover], the quality of the existing products is not yet up to [the] expectations of the studios. Color performance, seams, low lights, DCI compliance [and] sound are all topics to be worked on.

A: Absolutely. It’s an application that can bring real benefits to the moviegoer and exhibitor alike. Each year, we’re continuing to see interest, and [we’re] starting to see more real-world installations. We are actively working toward seeing LED in a cinema environment, which, we believe, will expand the capabilities of creatives to bring their vision to the screen, as well as improve the ability to maintain a high level of quality in the theaters.

Sound & Communications: What’s happening in the world of microLEDs?

A: There is so much activity here, [and] it’s very exciting. We could see the first products next year. LED-chip manufacturer PlayNitride just confirmed they can transfer 10,000 microLEDs per second with a 99.9-percent [manufacturing] yield. That yield is not good enough by itself, but they say their repair process can then effectively realize the required yield cost.

A: MicroLEDs could portend a huge change in mobile and fixed-display applications. They offer long life, high efficiency, great color, wide viewing angles and fast switching speeds. What’s not to like? (If you can make them…and afford them.)