The 23rd annual NSCA Business & Leadership Conference (BLC) with the opening keynote “Economic Outlook 2021 (and Beyond) for Integrators,” presented by Dr. Chris Kuehl.

Kuehl began by looking back at his predictions from NSCA’s previous BLC and how he, like most people, failed to predict just how much of an impact the COVID-19 pandemic would have on 2020. He joked that even working from home (WFH) hasn’t gone as smoothly as most expected (particularly for those of us with children and pets).

Outlook For 2021

Kuehl then shifted the discussion to the outlook for 2021 by first addressing how the Biden administration’s recovery plan, known as the American Rescue Plan, is predicted to impact the economy. According to Kuehl, there are two schools of thought regarding the stimulus package, with its combination of regulatory changes and government spending: it will either allow the economy to roar back, or it will be a recipe for stagflation. He explained that, based on the recent congressional testimony of US Federal Reserve Chair Jerome Powell, the US government is not showing signs of being worried about inflation and is instead focused on growth.

“If we’re looking at how different agencies are predicting the year, the big banks are more confident than they’ve been in a while,” Kuehl said. He added that the Congressional Budget Office and the International Monetary Fund are projecting 4.5% to 5% growth, but the big banks are predicting 6% to 6.5%. And regarding inflation concerns, Kuehl said “Yes, [central banks] are watching inflation. Yes, it’s an issue. So far, it’s not triggering any real decisions.”

Post-Pandemic Economy

When it comes to the fight against the pandemic itself, Kuehl explained that the US is actually the #5 country worldwide in terms of vaccine distribution, with about 11-12% of the population having already been vaccinated, and we’re on track to be mostly vaccinated by the summer. And according to Kuehl, all polls indicate that people are anxious to get back to their old patterns of behavior; however, only time will tell how quickly people will actually go back to their old routines as the pandemic wanes.

Kuehl added that the pandemic economy will not be permanent, but the changes in work patterns and consumer behavior may be, and these changes will have an effect on office and retail construction and design for the foreseeable future. When it comes to the WFH revolution, many workers have shifted to a 3-2-2 model (three days in the office, two days at home, two days for the weekend); as such, office designs will have to be built around that 3-2-2 model and will have to emphasize collaboration. And with the continued growth of online shopping being further boosted by the pandemic, retail spaces will have to further emphasize “service and entertainment” to provide a worthwhile in-store experience for the consumer.

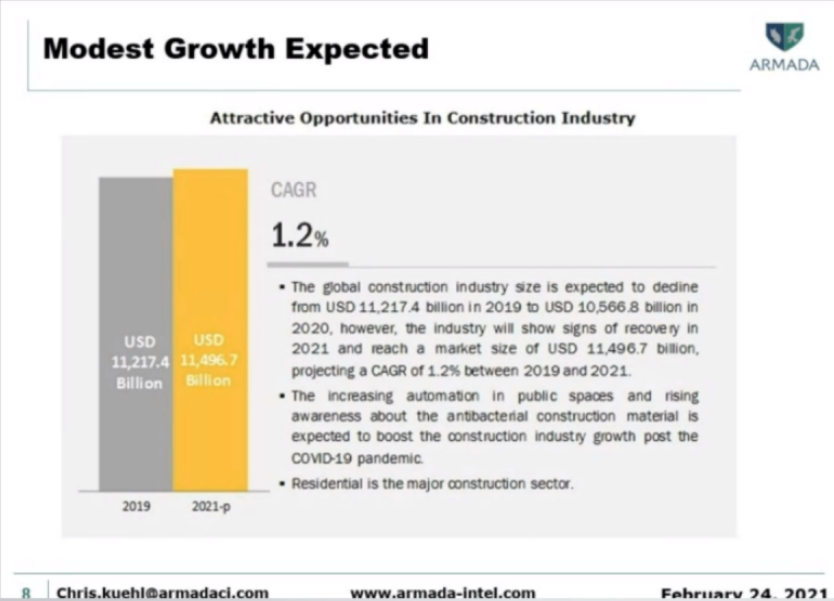

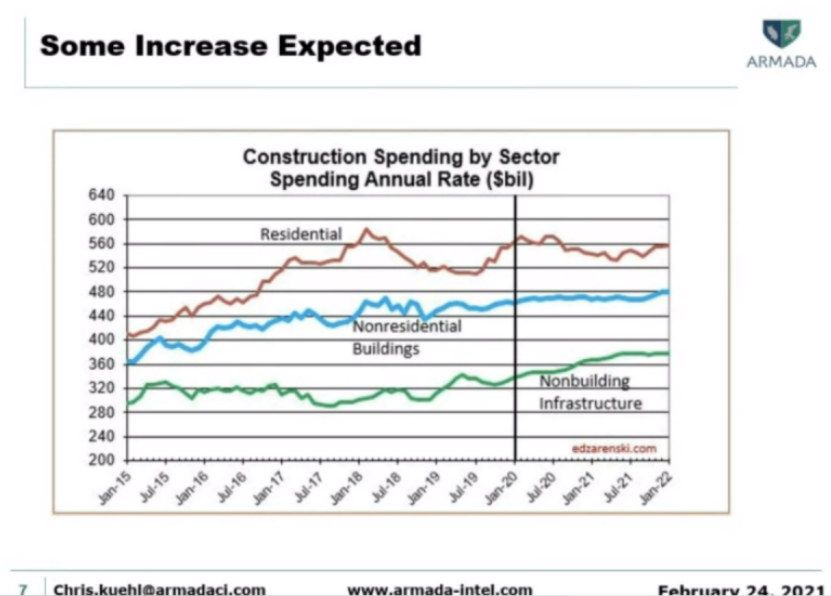

Stability Returning To Construction

Fortunately, Kuehl explained that a number of indicators point to stability returning to the construction market, particularly in the non-residential and public sectors. Thanks to the pandemic-induced changes in work behavior, there is a new push in the commercial sector around redesigning offices. Kuehl added that new office construction is still slumping, although commercial construction in general is holding steady. The pandemic has also seen continued growth in the medical sector (for obvious reasons) as well as warehousing. The growth in warehousing and distribution centers is likely due to the growth of online shopping, as well as an increased emphasis on inventory management spurred by pandemic-related supply-chain issues. And because the WFH revolution has decreased the need for offices in urban centers, new construction is increasingly moving to the periphery of urban areas.

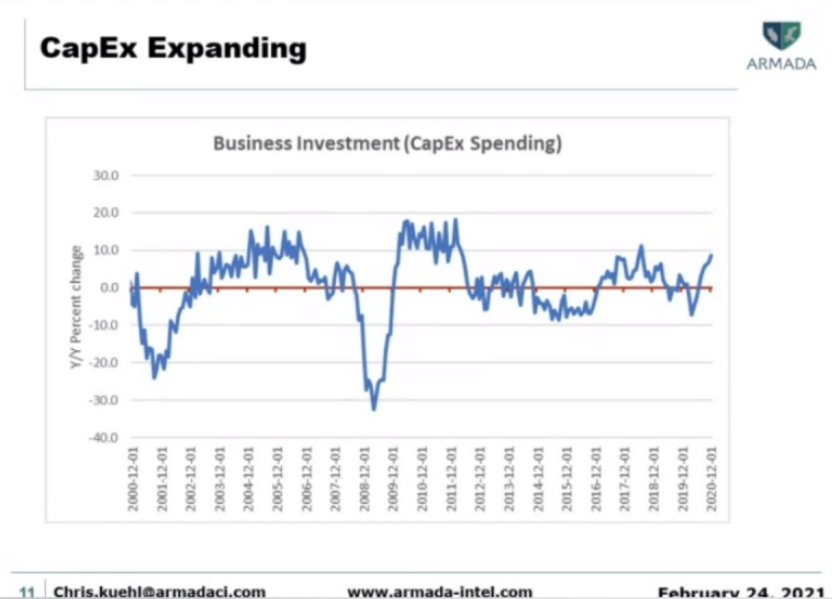

Kuehl also pointed to an across-the-board increase in capital expenditure spending in January 2021, indicating that businesses are ready to resume re-investing their capital in their business operations. “All these people who have talked about, ‘Well, we need to upgrade our systems, we need to improve, we need to catch up with new technology,’ but who have been stalling you for the last year are probably going to be a lot more receptive now,” Kuehl said. “They know that by delaying for a year, they set themselves back, and now they’re really going to have to catch up. Their competitors are going to make these moves, and if they don’t, then the competitor gets an edge.”

In the public sector, Kuehl joked that there is a constant demand for more infrastructure, but nobody wants to pay for it. However, the stimulus package will likely include plenty of money for infrastructure spending. Kuehl also suggested that the stimulus will likely include funding for private-sector construction, particularly as a means to promote “reshoring,” or efforts to bring manufacturing and warehousing back into the US to create jobs and protect against future supply-chain disruptions.

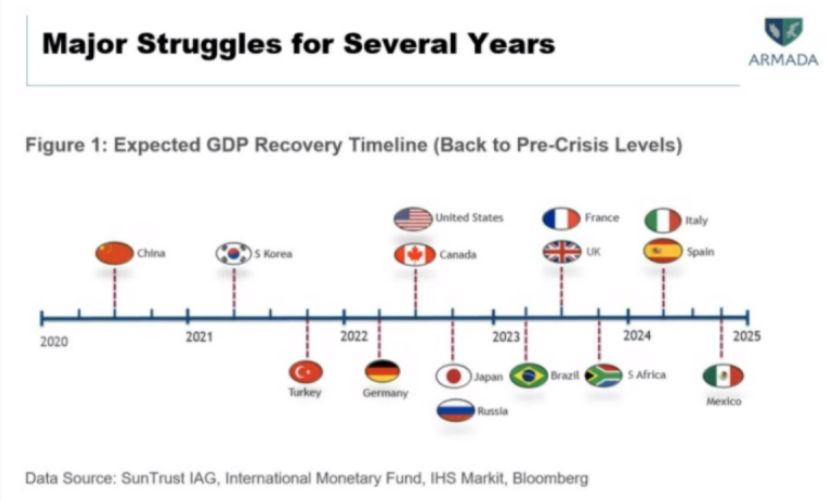

Global Recovery Outlook

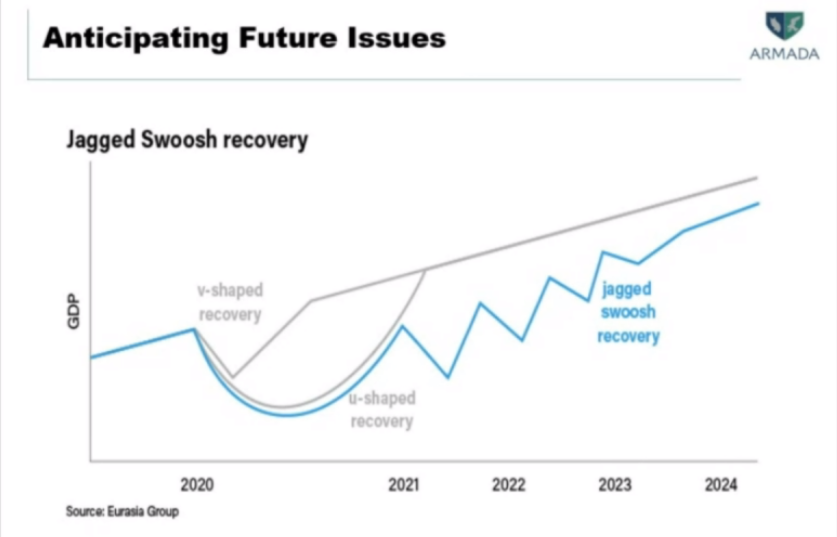

Kuehl then offered some projections for global recovery from the pandemic-induced recession. He indicated that all signs point to most countries seeing a full recovery by 2022, that 2021 would be a “transition year,” and that most economies should stabilize by 2024. However, he cautioned that the next few years will see a lot of start/stop growth, with periods of growth followed by periods of decline. “The caveat here is to not be shocked when the economy goes up and down, a good quarter here, a bad quarter here,” Kuehl said. “It’s not going to be smooth.”

All photos courtesy of Dr. Chris Kuehl and NSCA.