AVIXA’s market research analyzes the current state of the industry and what lies ahead.

Twenty-twenty has been a case study in how rapidly the world can change. For the first four months of the year, those changes were almost uniformly negative. Now, we’re hoping for the opposite trend. With luck, the second half of 2020 will see a burst of recovery that will have the economy and the AV industry drawing closer to their pre-pandemic levels. Full recovery can be expected later next year.

AVIXA has been closely monitoring the impact on the AV industry of the novel coronavirus (COVID-19), gathering data from numerous sources to understand the depth, breadth and distribution of the effects. Now, we can also share data from the new 2020 Industry Outlook and Trends Analysis (IOTA), which details the AV market size, including breakdowns by vertical market and solution area. In a stroke of fortunate timing, our refresh cycle happened to coincide with the onset of the pandemic, enabling us to produce timely and relevant data. Although the market continues to evolve quickly, these new numbers broadly incorporate the seismic impact that the COVID-19 crisis has had, as well as the likely course of recovery.

We also have a pair of briefer, but faster-moving, data sources. You might already be familiar with AVIXA’s Pro AV Business Index, which gives monthly readings of commercial AV sales and employment changes. Given the pace of change, in March we implemented a new, weekly “COVID-19 Impact Survey” to track the business impact of COVID-19. These capture the short-term fluctuations in our industry, and they measure more details than the total dollar market segments of IOTA.

Before we start to talk about recovery, it’s worth taking a moment to understand exactly what happened to commercial AV in the wake of COVID-19. Our monthly sales index, in existence since September 2016, turned negative for the first time ever in March. It was the largest fluctuation over the past 40 months. According to that measure, contraction continued at a similar rate in April before easing in May.

Our weekly “COVID-19 Impact Survey” offers a few interesting metrics. Perhaps the most pivotal question asks respondents how revenue in the previous week compared to pre-COVID-19 levels. From the week of March 20 to the week of June 12, revenue was down an average of 19 percent, with the deepest drop (28 percent) coming in the first week of May. The weekly survey shows canceled projects as the most common major business issue, followed by delayed orders and supply-chain difficulties. Our data suggests that end users have fared slightly better than providers have, and that live events have been particularly hard hit.

Despite the tough times, the commercial AV community is showing resilience and optimism. Companies are doing everything they can to adjust to current constraints and find revenue wherever possible. More than 60 percent of our global AV Insights Community has reported plans to expand into a new vertical or solution area over the next six months. New developments include building virtual-event models and reimagining corporate workflows.

This resilience will lead to recovery. But what will recovery look like? There has been a lot of debate about the shape the recovery will take: a “V,” a “U”… maybe a Nike swoosh. At AVIXA, we anticipate a mix between the “V” and the swoosh. At first, the recovery will proceed quickly, as lockdown restrictions ease and as many businesses reopen. But, after an initial burst of stronger growth, expect things to slow down. Until a vaccine puts COVID-19 in the rearview mirror, businesses will hesitate on both major investments and large events; likewise, consumers will avoid crowds and hesitate to make travel plans.

In addition, businesses and consumers alike have lost a lot of money during the crisis. Money that was earmarked for business expansion has had to go to just keeping companies afloat. And furloughed and laid-off workers aren’t able to spend as much money, leading to further revenue losses for businesses. The accumulated suffering will give the economy a hangover, and it will take a long time for the economy to be in a position as positive as it was at the start of the year.

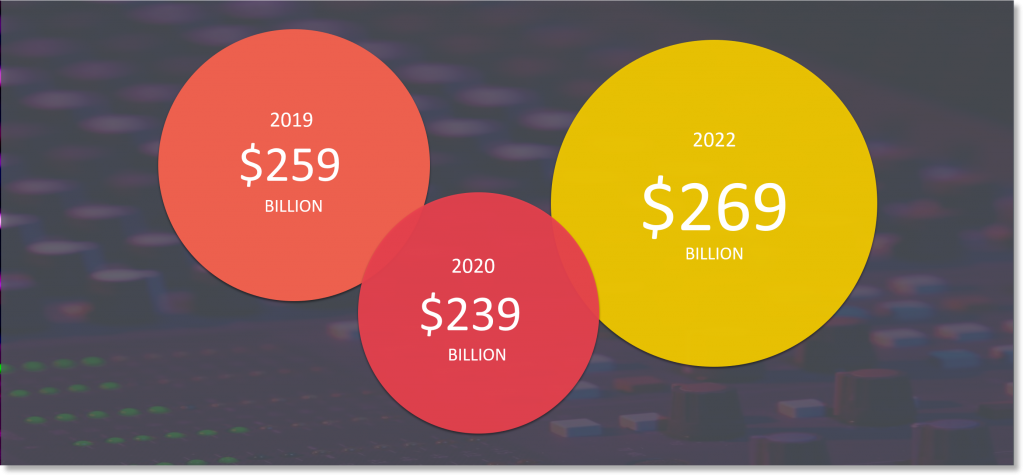

In total dollars, IOTA projects commercial AV revenue to come in at $239 billion for this year, 7.7 percent lower than it was in 2019. Commercial AV will start to bounce back in the second half of this year—that’s how we manage a single-digit drop, despite absorbing double-digit drops in March, April and May—but full recovery will take more time.

The day when the total commercial AV revenue stream reaches its pre-COVID-19 volume should come in 2021. Summing over the full year, though, we expect total 2021 revenue to remain below the 2019 level. Total 2022 revenue will then be greater than 2019 had.

Sometime in 2021, commercial AV revenue will reach its pre-COVID-19 levels; however, for the majority of the year, it’ll be lower than 2019. That means the 2021 total will be below the 2019 total, but, if you look at a smaller timeframe, the moment that the pace of revenue surpasses 2019’s pace will happen in 2021. By 2022, the commercial AV industry will again set a new revenue record.

Among vertical markets, hospitality, venues and retail will be the hardest hit this year; fortunately, these will also see some of the strongest recovery growth in 2021. Transportation, energy, and media and entertainment are the most favorable verticals, as they combine only modest contraction this year—about four percent—with strong growth in 2021.

Among solution areas, the live-events category is the hardest hit, projected to decline 21.8 percent this year. It is anticipated to grow strongly in 2021, although not enough to make up for its precipitous drop. The standout solution area is security and surveillance, which IOTA sees declining just 1.2 percent this year (before growing at a gangbusters 14.6 percent next year). Content distribution is the bright spot of this year, staying virtually steady thanks to businesses pivoting from in-person activities to livestreaming.

Twenty-twenty has shaken our industry to its foundations. AVIXA’s Pro AV Business Index, the weekly “COVID-19 Impact Survey” and the IOTA report all agree that this year is a historically tough time for the industry. But they also give reason for hope. Our industry has shown remarkable resilience, and it’s starting on the road to recovery. It will take time, but AV will overcome.

For more business-centric articles from Sound & Communications, click here.